excise tax nc formula

Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax. Definition of Excise Tax.

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

CRP RRP E1AV.

. 1 2020 Information Who Must Apply Cig License. An excise tax is an indirect tax charged on the sale of a particular good. The tax rate is one dollar 100 on each five hundred dollars 50000 or.

Have you ever wondered how to calculate the revenue stamps excise tax on the sale of real estate in North Carolina. The tax rate is 2 per 1000 of the sales price. Since excise taxes can be levied by the feds the state and the city they can add up certain items.

Customarily called excise tax or revenue stamps. An excise tax is a tax on the transfer of ownership from the seller to the buyer paid at closing. Excise Tax Technical Bulletins.

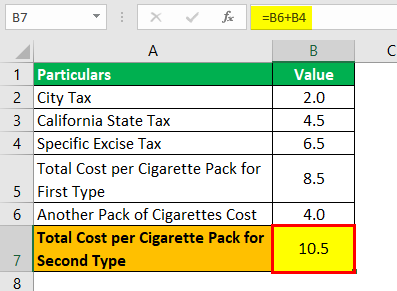

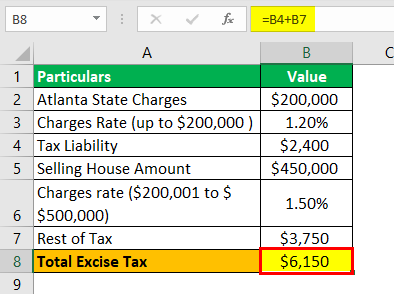

The excise tax is imposed on the manufacture sale or use of a certain commodity or the provision of a particular service. PO Box 25000 Raleigh NC 27640-0640. Since it is a specific excise tax the applicable formula is Tax Liability Quantity Tax per Unit.

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Sales Sales Tax. The federal tax remains at 1010.

The tax amount is based on the sale price of the home and varies by. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. How can we make this page better for you.

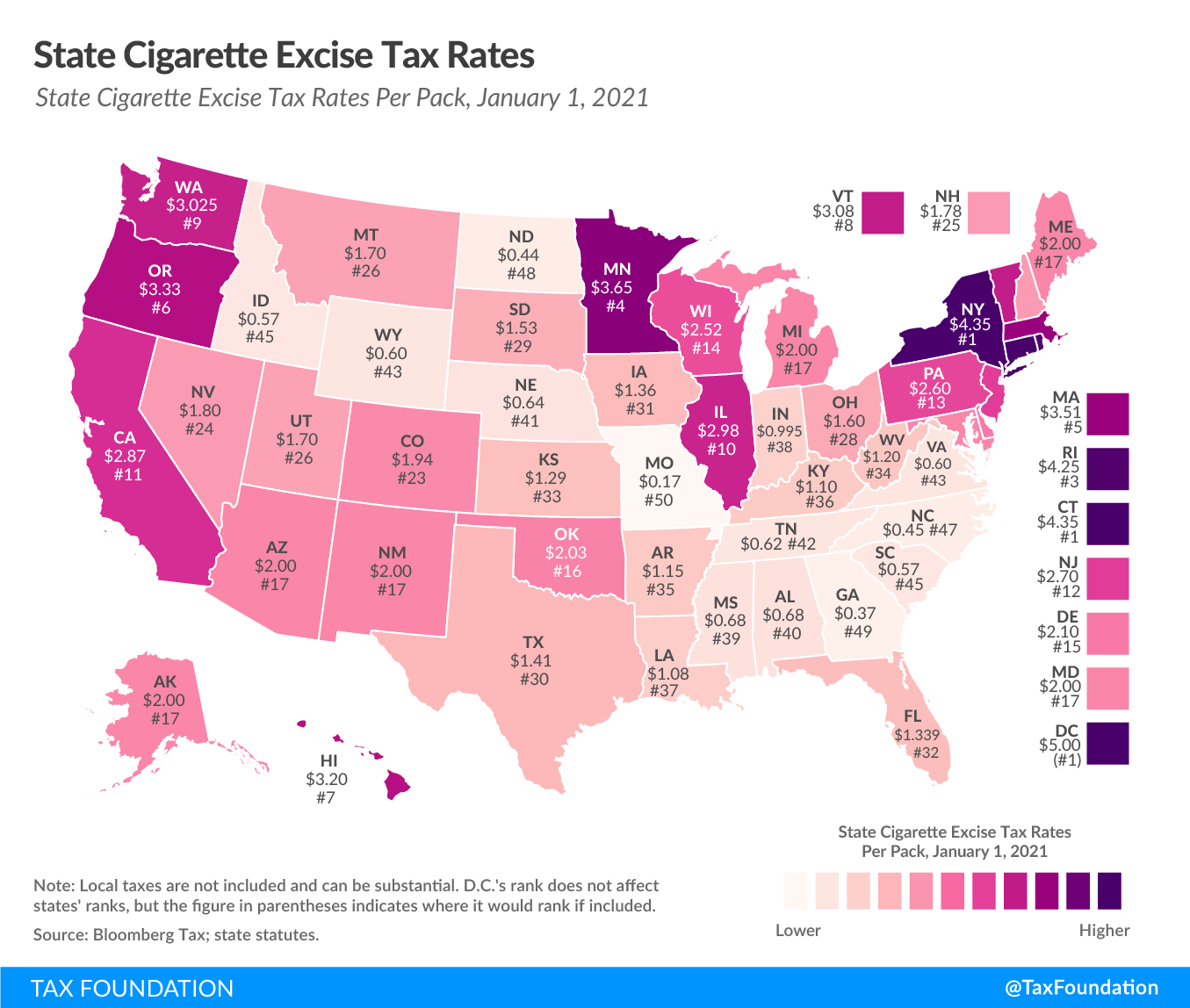

350barrel applies to the first 60000 barrels for a domestic brewer who produces less than 2 million barrels per year. Federal tax department charges the firm an excise duty worth 3 per liter. Returning to the District of Columbia local cigarette-specific excise taxes are 498 per pack of.

Through June 30 2022 the state excise tax on cigarettes ranges from 0170 per pack in Missouri to 4350 per pack in Connecticut and New York. North Carolina Department of Revenue. The tax rate is 2 per 1000 of the sales price.

So if you purchase a home or land for 900000 the revenue tax would be 900000 divided by 1000 and multiplied by 2 which. E Federal Specific Excise Tax State Specific Excise Tax x Ounces Sold128 AV On- or Off-Premises Ad Valorem Excise Tax. Beer Federal Tax Calculator.

All spirituous liquor sold at retail in North Carolina ABC stores is priced uniformly throughout the state. North Carolinas transfer tax rates are straightforward expect to pay 1 for every 500 of the sale price. The tax can be imposed and collected at the point of.

This title insurance calculator will also. Indirect means the tax is not directly paid by an individual consumer. The price of spirituous liquor is determined by a mark-up formula as stated in GS.

For the states average home value of 320291 the transfer tax would. The tax rate is one dollar 100 on each five hundred dollars 50000 or.

Excise Tax In The United States Wikiwand

What Is Excise Tax Small Business Owner Responsibilities

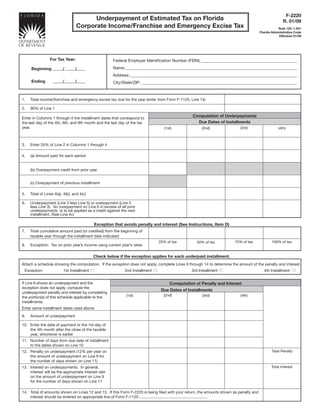

Underpayment Of Estimated Tax On Florida Corporate Income Franchise

Calculating Excise Tax Help With Closing Statments Youtube

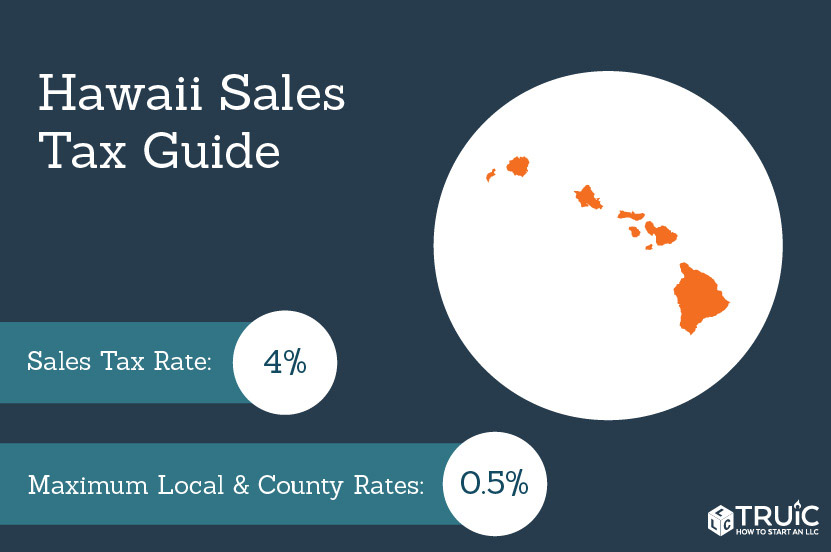

Hawaii General Excise Tax Small Business Guide Truic

Excise Taxes Excise Tax Trends Tax Foundation

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Federal Excise Taxes The Proper Role Of Excise Taxes Tax Foundation

Excise Tax Definition Types Calculation Examples

Fuel Taxes In The United States Wikipedia

Tobacco Tax Computation Excise And Total Tax Liabilities 2016 2017 Download Table

Excise Tax Real Estate Exam Prep For North Carolina Youtube

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

How Do State And Local Corporate Income Taxes Work Tax Policy Center

How To Calculate Tax Stamps In North Carolina